Essential To-Do Tasks Before the UK Tax Year Ends on 5th April

Chris Barnard • March 25, 2025

Essential To-Do Tasks Before the UK Tax Year Ends on 5th April

As we approach the end of the UK tax year on 5th April, now is the time to take action and ensure you’ve done everything possible to minimise your tax liabilities and maximise your allowances. Whether you’re a business owner, self-employed, or simply looking to optimise your personal finances, these final weeks are crucial.

Many tax reliefs and allowances operate on a use-it-or-lose-it basis, meaning that once the new tax year begins, any unused benefits will be lost forever. With tax thresholds tightening and changes on the horizon, taking advantage of what’s available now can make a real difference to your finances.

In this guide, we’ll walk you through five essential tasks to complete before the tax year ends. These steps will help you keep more of your hard-earned money while staying compliant with HMRC regulations.

1. Use Up Your Tax-Free Allowances

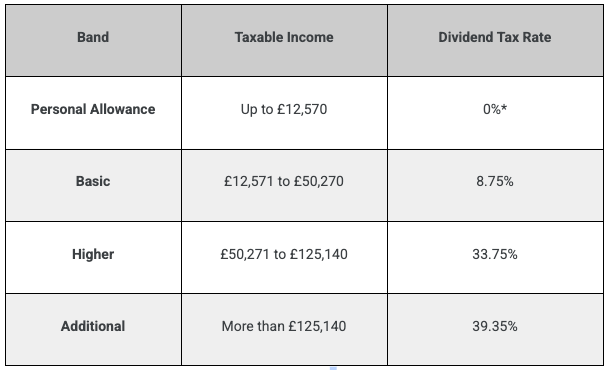

The UK tax system provides several annual allowances that can help you reduce your tax bill, but if they aren’t used before 5th April, they reset and are lost. The Personal Allowance for the 2023/24 tax year is £12,570, meaning income up to this amount is tax-free. If you have flexibility over how you receive income - such as salary, dividends, or bonuses - you may want to adjust your payments to ensure you fully utilise this tax-free amount.

*0% applies within the Personal Allowance threshold

For those receiving dividends from a limited company, the Dividend Allowance for 2023/24 is £1,000, but it will fall to just £500 in the next tax year. If you haven’t yet taken advantage of this allowance, withdrawing additional dividends before 5th April could be beneficial. Similarly, if you’re planning to sell assets that may be subject to Capital Gains Tax (CGT) - such as shares or property - it’s worth knowing that the tax-free CGT allowance is £6,000 this year but will drop to £3,000 in 2024/25. If you were already considering a sale, acting before the tax year ends could save you money.

Key takeaways:

- Use your Personal Allowance of £12,570 before it resets.

- Withdraw dividends before the Dividend Allowance drops to £500 next tax year.

- Consider selling assets now to benefit from the CGT allowance or to realise a loss which can be used against other CGT profits.

- Use your basic rate band to take advantage of lower dividends tax rates.

2. Maximise Pension Contributions for Tax Relief

Pensions remain one of the most tax-efficient ways to save for the future, and making contributions before the tax year-end can also reduce your tax bill today. Personal Pension Contributions to a pension scheme attract tax relief at your highest rate of income tax - meaning a £1,000 contribution effectively costs only £800 for basic-rate taxpayers, £600 for higher-rate taxpayers, and £550 for additional-rate taxpayers.

The Annual Allowance for pension contributions is £60,000 per year. However, high earners with incomes over £260,000 may have a reduced (tapered) allowance. If you haven’t used your full pension allowance over the past three years, you may be able to carry forward any unused amounts, allowing you to contribute more than £60,000 in the current year.

If you receive employer pension contributions from a company, these are treated as a business expense, reducing profits and therefore lowering corporate tax. To benefit from this tax relief, contributions must be made before the end of the company’s financial year, which may not necessarily align with the 5th of April. The tax savings on these contributions typically range between 19% and 25%.

Key takeaways:

- Pension contributions reduce taxable income, potentially saving higher-rate taxpayers thousands.

- The Annual Allowance is £60,000, but unused allowances from the past three years can still be used.

- Contributions made before 5th April qualify for tax relief in this tax year.

3. Make the Most of Your ISA Allowance (£20,000 Limit)

An Individual Savings Account (ISA) is one of the most tax-efficient ways to save or invest, as all interest, dividends, and capital gains are completely tax-free. Each tax year, you can invest up to £20,000 into an ISA, but if you don’t use this allowance before 5th April, it is lost. However, an ISA is only worthwhile if your annual interest exceeds £1,000 as a basic-rate taxpayer, since HMRC already allows the first £1,000 of interest to be tax-free for basic-rate taxpayers and £500 for higher-rate taxpayers.

If you have savings sitting in a standard bank account earning interest, moving funds into an ISA before the deadline could prevent you from paying unnecessary tax. If you’re investing in a Stocks & Shares ISA, it’s a great opportunity to shelter investments from future CGT or dividend tax increases.

Key takeaways:

- ISAs provide tax-free growth on savings and investments.

- The £20,000 ISA limit resets on 6th April, so use it before it’s gone.

- Consider transferring funds into a Stocks & Shares ISA for tax-free investment growth.

4. Claim Any Last-Minute Business Expenses

If you’re self-employed, reducing your taxable profits before year-end can lower your tax bill. Reviewing and claiming legitimate business expenses before 5th April is a smart move. For companies the cut off is your company year end which could be any date in the year, however tax free benefits such as trivial benefits and staff parties reset on 6th April.

Common tax-deductible expenses include business travel, equipment, software, professional subscriptions, and home office costs. If you were planning to invest in new equipment or services, bringing forward these purchases could provide an immediate tax deduction, reducing your Corporation Tax or Income Tax bill.

For limited company directors, you might also consider making additional pension contributions through your company. Employer pension contributions are a fully deductible business expense and can be a tax-efficient way to extract profits.

Key takeaways:

- Claim all eligible business expenses before the tax year ends.

- Bringing forward planned purchases could reduce taxable profits.

- Directors can benefit from tax-efficient pension contributions.

5. Plan for Inheritance Tax (IHT) & Gift Allowances

Inheritance Tax (IHT) can take a significant portion of an estate, but proactive planning helps reduce this burden. Each tax year, you can gift up to £3,000 tax-free, and if you didn’t use last year’s allowance, you could give away £6,000 before 5th April.

Small gifts of up to £250 per person don’t count towards IHT if given to different individuals, and regular gifts made from excess income can also be tax-free. If you’re considering estate planning, using these allowances now can help reduce future tax liabilities and pass more wealth onto loved ones.

Key takeaways:

- Use your £3,000 annual gift allowance (or £6,000 if you missed last year).

- Consider small gifts of £250 per person to multiple people.

- Early gifting can reduce future Inheritance Tax liabilities.

Final Thoughts: Take Action Before 5th April

With the end of the tax year fast approaching, now is the time to act and optimise your financial position. Many tax-saving opportunities disappear once the new tax year begins, so reviewing your allowances, contributions, and expenses now could mean significant savings.

If you’re unsure where to start or want tailored advice, Collective Concepts Accounting is here to help. Our expert team can guide you through last-minute tax planning strategies to ensure you’re making the most of every opportunity.

📞 Contact us today to secure your financial future before the 5th April deadline!

Related Posts

© 2023 All Rights Reserved Collective Concepts Accounting Ltd. Registered office is Sussex Innovation Centre, Science Park Square, Brighton, BN1 9SB. Company Registration Number 14158965