Multiple Dwellings Relief for Stamp Duty: Act Now before the 31 May 2025 Deadline

Chris Barnard • February 27, 2025

Multiple Dwellings Relief for Stamp Duty: Act Now before the 31 May 2025 Deadline

If you're a property investor or business owner, you’ll know that Stamp Duty Land Tax (SDLT) is one of the biggest costs when acquiring property. This tax applies to transactions exceeding certain thresholds, with rates increasing based on property value.

Until recently, Multiple Dwellings Relief (MDR) provided a valuable opportunity to reduce SDLT when purchasing multiple properties in a single transaction. However, as of 1st June 2024, MDR has been abolished, removing this financial advantage for investors.

Property investors still have 12 months from completion to make the Multiple Dwellings Relief claim if they meet specific conditions.

This means property sales up to 1st June 2024 can still qualify for MDR, provided the application is done and accepted by 12 months of the property completion date. For example if you completed on 15th May 2024, you have until 14th May 2025 for HMRC to accept the MDR claim.

In this article, we’ll break down what MDR was, who can still claim it, and the necessary steps to take before the deadline to ensure you don’t miss out on valuable tax relief.

1. Understanding Stamp Duty Land Tax (SDLT)

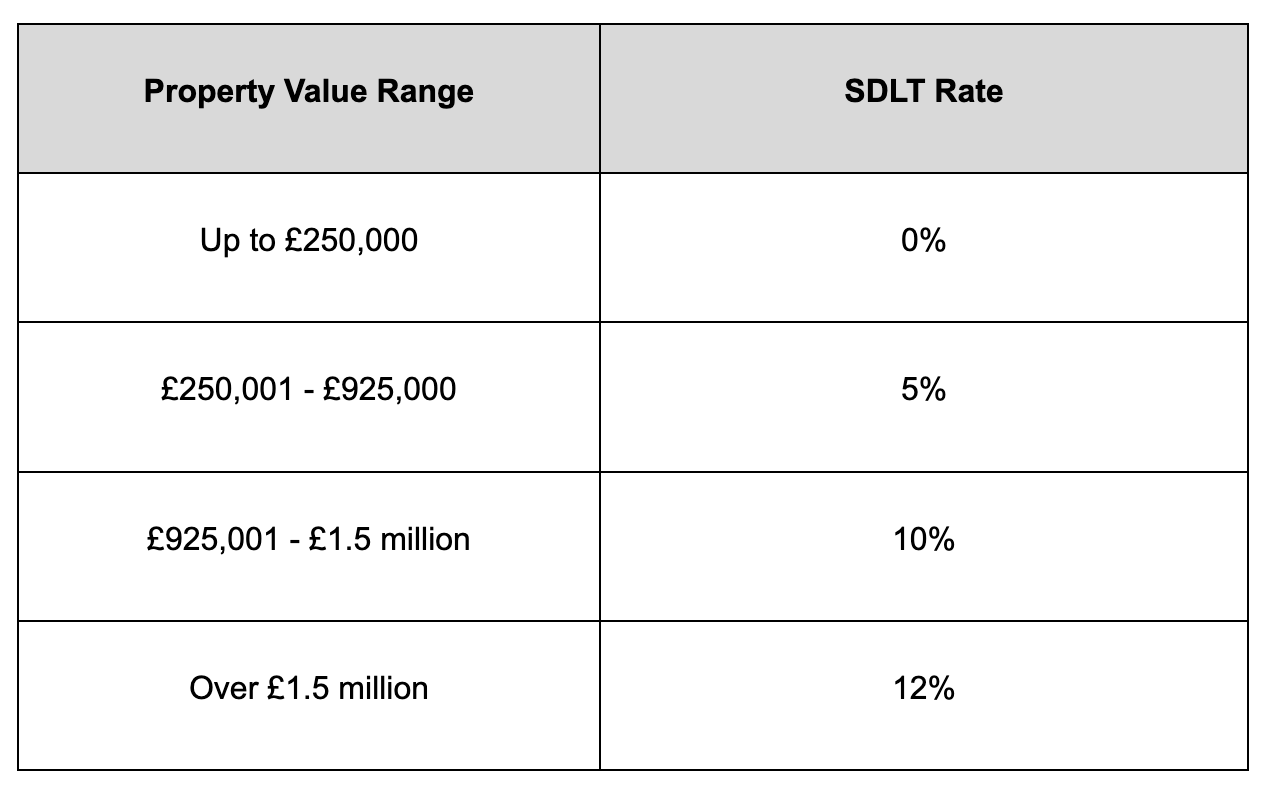

SDLT is a tax imposed on property and land transactions above a certain threshold in England and Northern Ireland. The rate you pay depends on the value of the property and your circumstances as a buyer. SDLT can significantly impact property investment costs, and understanding the applicable rates and surcharges is crucial for financial planning.

The following table outlines the standard SDLT rates for residential property purchases:

In addition to these standard rates, additional SDLT charges apply in specific circumstances. If you are purchasing a second home or a buy-to-let property, an extra 3% surcharge is added to the standard SDLT rate. Non-UK residents face an additional 2% surcharge on top of the standard rates, making property acquisitions more expensive for international buyers. Companies purchasing residential properties valued over £500,000 may also be subject to a 15% SDLT rate, significantly increasing acquisition costs.

Given these complexities, it’s essential to factor in SDLT when planning property investments. This tax can have a substantial impact on profit margins, especially for investors acquiring multiple properties. Reliefs such as MDR were previously valuable tools in reducing SDLT liabilities, but with its abolition, understanding your tax obligations has never been more important.

2. What was the recently abolished Multiple Dwellings Relief (MDR)?

MDR was an SDLT relief designed to reduce the tax liability for investors purchasing multiple dwellings in a single transaction. Instead of calculating SDLT based on the total purchase price, MDR allowed buyers to divide the total price by the number of dwellings and apply the SDLT rates to this lower per-dwelling value. This often resulted in a lower overall SDLT bill and significantly reduced the financial burden for property investors.

This relief was particularly beneficial for developers looking to acquire multiple residential units in a block or estate, landlords expanding their rental property portfolios, and property investors purchasing multiple buy-to-let units in one transaction. By reducing the SDLT liability, MDR helped improve cash flow for property businesses and made large-scale property investments more viable.

3. What Qualifies as a Dwelling?

To claim MDR, each property in the transaction needed to qualify as a “dwelling.” Legally, this is more complex than simply considering whether a property functions as a home. The unit should have its own kitchen, bathroom, and sleeping area, ensuring it can function as an independent living space.

Additionally, the property must have the appropriate planning consent for separate residential use. Factors such as whether the unit is physically separate from other properties, with it’s own front door and its ability to be independently let or sold all play a role in determining whether it qualifies.

Assessing whether a property meets the definition of a dwelling requires careful evaluation. For example, annexes or granny flats may qualify if they are fully self-contained, whereas rooms within a shared house may not. Some properties, such as student accommodations or serviced apartments, exist in a grey area where eligibility depends on specific legal and functional aspects.

4. Abolition of Multiple Dwellings Relief: What Has Changed?

As of 1st June 2024, MDR has been abolished, meaning any transactions completed after this date are no longer eligible for MDR. The government's decision to remove this relief followed a review of its effectiveness. According to recent analysis, MDR was being used in ways that did not align with its original policy intention, leading to revenue losses for the Treasury.

One of the primary reasons for abolishing MDR was concerns over misuse. The relief was originally designed to encourage the development of multiple dwellings in a single transaction, helping to boost housing supply. However, the government found that MDR was increasingly being used to minimise SDLT liabilities in transactions where the intended benefit was unclear. In some cases, investors and developers structured purchases specifically to reduce their tax burden rather than to support housing availability.

Although MDR has been abolished, property investors who meet specific conditions may still claim relief if they act promptly. Those who completed transactions before the cut-off date have a limited window to submit claims, making it crucial to review past purchases as soon as possible.

5. Key Deadline: 31st May 2025 – Your Last Chance to Claim

If you completed a qualifying transaction before 1st June 2024, you have until 31st May 2025 to make an MDR claim. Property investors still have 12 months from completions up to 1 June 2024 to make the Multiple Dwellings Relief claim if they meet specific conditions.

Property investors who completed purchases before 1 June 2024 and have not yet claimed MDR should review their transactions immediately. Given the significant financial implications, taking action sooner rather than later is essential. Reviewing past property transactions could uncover unexpected savings, especially for those who purchased multiple properties but were unaware of the relief or failed to apply at the time.

6. Steps to Take Before the Deadline

To ensure you don’t miss out, review past property transactions to determine if they qualify under the old MDR rules. If you completed or exchanged before the relevant cut-off dates, confirm eligibility by seeking professional advice. Next, gather all necessary documentation, including contracts, SDLT calculations, and planning permissions, to support your claim. Finally, submit your claim to HMRC well before the 31st Mayl 2025 deadline. Delays in processing or incomplete documentation could result in losing the relief, so acting sooner rather than later is essential.

Conclusion

MDR was a valuable tax relief that helped property investors save significant amounts on SDLT. With its abolition, investors only have one final opportunity to claim it - but the clock is ticking.

If you believe you might qualify, don’t wait. Contact Collective Concepts Accounting today to review your transactions and submit your claim before the 31st May 2025 deadline.

Our team specialises in tax planning for property investors and can ensure you receive the maximum tax relief possible. Get in touch now to secure your savings before it’s too late.

Related Posts

© 2023 All Rights Reserved Collective Concepts Accounting Ltd. Registered office is Sussex Innovation Centre, Science Park Square, Brighton, BN1 9SB. Company Registration Number 14158965